Is the credit window closing for Latin America?

There continue to be successful IPOs in Latin America. Corporations from the region usually get credit abroad without any problems. This is also true for most countries. Nevertheless, it looks as if financing will become more difficult for Latin America.

by Alexander Busch, Latin America correspondent for Handelsblatt and Neue Zürcher Zeitung

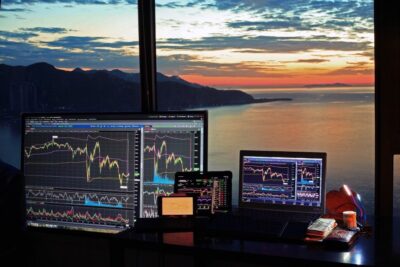

The good news first: 20 companies have already successfully launched their shares on the São Paulo stock exchange this year. This is more than at the same time last year. In 2020, a record 27 companies opened their capital as shares in initial public offerings (IPO) at B3. Until recently, everything looked like there would be a new issuance record this year. After all, around 40 more companies have now registered to raise capital on the stock exchange.

But, and this is the bad news: This seems increasingly unlikely. Around 30 IPOs or secondary issues have already been canceled this year. Only one in five IPOs has generated profits for investors so far.

In other respects, too, it currently looks as if the credit window in Latin America may be narrowing. Professional investors are becoming more reluctant to invest their capital in Latin America. This is a trend that already started last year, as the Bank for International Settlements (BIS) just noted: According to the report, Latin America was already the only emerging market region where banks reduced bond volumes last year. The region lost $39 billion last year, with Brazil alone recording a $22 billion drop.

Investment bank JP Morgan expects financing for Latin America to be tighter this year. Latin American bonds have seen the sharpest losses in yields worldwide. In Brazil, Colombia and Peru, losses have even reached double digits since the beginning of the year.

This will not change anytime soon, according to JP Morgan. Continued high COVID infections and slow vaccination campaigns will continue to delay growth in Latin America. It remains possible that a third wave of Corona mutants will cause new setbacks in the region. In addition, inflation is rising, due to high food and energy prices. Central banks are raising interest rates, slowing the economy. Few governments still have financial leeway in their budgets to mitigate the social consequences of the pandemic – and if they do, it will only be at the cost of further interest rate hikes or rising debt.

Rising political tensions in almost all countries are also making Latin American bonds unattractive to institutional investors, JP Morgan said.

The good news for the region came from Washington yesterday: The U.S. Federal Reserve will not be raising interest rates anytime soon. For Latin America, that means a reprieve.

COVID-19 in Latin America

Development of case numbers in the region

Currently reported cases in the countries

COVID-19 vaccine doses administered

Vaccine doses administered by country